When bookkeeping breaks down, MyLedger steps in.

Turn bank statements and messy histories into compliant financials — under accountant control.

Not DIY bookkeeping. Built for messy, bank-statement-first clients — not clean Xero-ready workflows.

Who it's for — and who it's not

MyLedger is accountant-controlled compliance recovery. We help you turn messy histories into compliant financials — not replace your expertise.

For

- Catch-up bookkeeping and historical clean-up

- High-volume micro clients, bank-statement workflows

- M&A firms needing standardised production

Not for

- Only accept clean Xero-ready clients

- Advisory-only boutiques without compliance work

- Looking to replace accountants with AI

Workflow

Three-step compliance recovery workflow — from bank statements to compliant financials.

Ingest

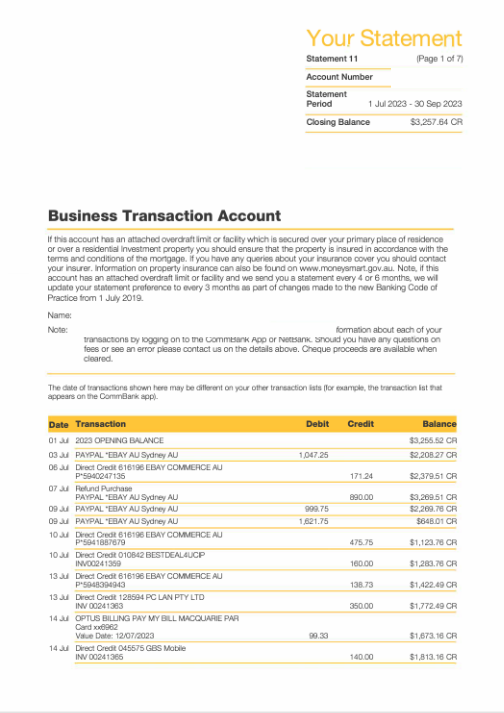

Bank statement / PDF / screenshot — drop it in, MyLedger imports instantly.

Rebuild

AI suggests. Accountants decide. Everything is reviewable.

Deliver

BAS / tax-ready outputs + working papers — compliant financials ready for review.

Most firms start with MyLedger. Practice Manager is optional.

Key capabilities for compliance recovery

Essential features that turn messy inputs into reviewable, BAS/tax-ready outputs.

Proven in production

Built by Australian accountants, refined in production over a decade.

Save ~90% time on reconciliation & working papers

MyLedger prepares financial statements in minutes with automated checks.

50K+ complex tax returns processed

Successfully powers Tax7, a multi-million dollar accounting firm.

10+ years of proven algorithms

Continuously tested, refined, and improved in real-world use.

Bank-level security for your client data

Australian Data Storage

All data stored in Australian data centers. Compliant with Australian Privacy Act.

MFA / SSO

Multi-factor authentication and Single Sign-On with Microsoft Azure AD.

ISO 27001 Aligned

Follows ISO 27001 information security management standards.

Onboarding

Three simple steps to launch—built for Australian small/micro firms

Apply (5 min)

Apply and schedule a quick discovery call. We qualify fit based on client type and workflow.

Onboard (2~3 sessions)

Onboarding and training, assisted completion of the client's books and compliance works.

Go live (Day 1)

Start delivering BAS/tax-ready outputs immediately.

Integrates with Xero, MYOB, and ATO

View all integrations