MyLedger

Turn bank statements into financial statements in minutes with AI-assisted reconciliation. Save 90% of your reconciliation time.

What MyLedger does

Comprehensive accounting automation that transforms raw data into professional financial statements

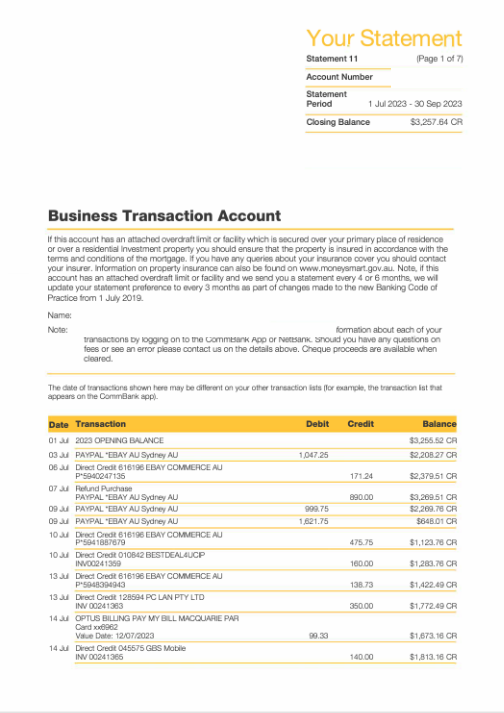

Transform Raw Data

Convert bank statements, PDFs, Excel files, and screenshots into clean financial statements automatically.

AI Auto-Categorization

AI learns your coding patterns and automatically categorizes 90%+ of transactions accurately at 200 transactions per minute.

Smart Reconciliation

Automatically detect unusual transactions, duplicates, and missing entries. Flag anomalies for quick review.

Working Papers Suite

Division 7A management, depreciation calculations, amortization schedules, and tax compliance tools.

Chart of Accounts Management

Custom categories with GST tracking, ITR label mapping, and practice default templates for consistency.

Journal Entry System

Complete journal entry management with pre-built templates for Income Tax, PAYG, Superannuation, and more.

Financial Reporting

Generate Balance Sheets, Income Statements, Trial Balance, BAS Summary, and ITR Reports with period comparisons.

ATO Integration

Retrieve client information, accounts, lodgement, due dates. Auto-reconcile GST, PAYG, and tax payments.

Open Banking Integration

Connect directly to bank feeds for real-time transaction import. Supports multiple Australian banks.

SmartDoc - Bulk Receipt Processing

Upload receipts in bulk and automatically match them to transactions. AI extracts receipt data and links documents to ledger entries seamlessly.

Key Capabilities

Everything you need to automate your accounting workflow

Multi-Format Import

- PDF bank statements

- CSV/Excel files

- Screenshots

- Open Banking feeds

- Prior year statements

AI-Powered Processing

- 200 transactions/min

- Pattern learning

- Auto-categorization

- Comment suggestions

- Bulk operations

ATO Integration

- GST reconciliation

- BAS lodgement sync

- Account reconciliation

- Payment tracking

- Due date management

Financial Statements

- Balance Sheet

- Income Statement

- Trial Balance

- BAS Summary

- ITR Reports

Working Papers

- Division 7A loans

- Depreciation schedules

- Amortization

- Tax adjustments

- Compliance checklists

Export & Sharing

- PDF export

- Excel export

- Secure sharing links

- Client-ready reports

- Multi-format support

SmartDoc Receipt Management

- Bulk receipt upload

- Auto-match to transactions

- AI receipt data extraction

- Document linking

- Receipt categorization

How MyLedger works

From bank statement to financial statement in five simple steps

Upload bank statements or connect feeds

Import data from any format—CSV, PDF, Excel, screenshots, or direct Open Banking feeds. MyLedger handles multiple file types and processes them automatically.

AI extracts and categorizes transactions

Advanced OCR and AI technology extracts transaction data and automatically categorizes based on learned patterns. Review and adjust suggestions with one click.

AI suggests mappings and categories

The AI analyzes transactions and auto-categorizes based on learned patterns. Review suggestions with one click. Process up to 200 transactions per minute.

Reconcile with ATO data automatically

Seamlessly integrate with ATO to reconcile GST, BAS lodgements, tax payments, and account balances. Flag discrepancies for review.

Generate financial statements and export

Export professional financial statements, working papers, and reports ready for review. Generate Balance Sheets, P&L, Trial Balance, and BAS summaries.

Integration & Compatibility

Works seamlessly with your existing tools and workflows

Integrations

- Xero Practice Manager (Live)

- ATO Portal (Live)

- Open Banking (Live)

- LodgiT (Coming Soon)

- Xero Accounting (Live)

File Format Support

- PDF bank statements

- CSV/Excel files

- Scanned documents

- Screenshots

- Prior year financial statements

Browser Compatibility

- Chrome (Recommended)

- Firefox

- Safari

- Edge

- Mobile browsers supported

Export Formats

- PDF financial statements

- Excel spreadsheets

- CSV data files

- Secure sharing links

- Client-ready reports

Use Cases

Perfect for different client types and accounting scenarios

Monthly Reconciliation

Process monthly bank statements, reconcile transactions, and generate financial reports in minutes instead of hours.

Year-End Preparation

Complete year-end financial statements, tax calculations, and working papers with automated reconciliation.

BAS Preparation

Automatically reconcile GST, prepare BAS statements, and ensure compliance with ATO requirements.

Company Accounts

Handle company financial statements, profit appropriation, dividend statements, and Division 7A loans.

Trust Accounting

Manage trust distribution statements, beneficiary allocations, and trust-specific reporting requirements.

Partnership Reporting

Generate partnership financial statements, member benefit statements, and partnership-specific reports.

Outcomes you'll see

Real results from real accounting practices

To complete statements

Not hours or days

Reduction in manual work

Automated categorization

Transactions per minute

Lightning-fast processing

vs. Manual Process

- ✗Hours of data entry

- ✗Error-prone categorization

- ✗Inconsistent coding

- ✗Manual ATO reconciliation

with MyLedger

- ✓Minutes to complete

- ✓AI-powered accuracy

- ✓Consistent across clients

- ✓Automatic ATO sync

Explore MyLedger Features

Dive deeper into specific capabilities

Ready to try MyLedger?

Apply for access and experience how MyLedger can transform your accounting practice. Save 90% of your reconciliation time.